Straight Life Annuity At Fcd

In return, you will receive income for the rest of your life. Generally speaking, an annuitant buys a straight life annuity and makes installment payments for it throughout his/her working life.

Apfaorg

A straight life annuity, sometimes called a straight life policy, is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

Straight life annuity at fcd. 35 continuous deferred life annuities. A straight life annuity, sometimes called a straight life policy, is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a. Like all annuities, a straight life annuity provides a guaranteed income stream until the death of the annuity owner.

Similarly one may ask, what settlement. A straight life annuity is often used to provide an income stream in retirement. The annuitant usually purchases the annuity with a lump sum deposit, and the insurer promises to make a fixed regular payment to the annuitant for life.

No survivor benefit will be paid upon your death. A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life. Subaccount the investment funds offered in variable annuity contracts are often called subaccounts.

When the annuitant dies, no further payments are made to anyone. What is a straight life annuity? Typically, you buy one and make regular payments during your working life or pay a single lump sum, usually after retirement.

If the annuitant dies before the annuity fund (i.e., the principal) is depleted, the balance. A straight life annuity is an insurance contract that pays out a series of fixed payments over the life of the owner, or annuitant. The straight life annuity that is actuarially equivalent to the participant's form of benefit shall be determined under this subsection (a) if the form of the participant's benefit is either (1) a nondecreasing annuity, other than a straight life annuity, payable for a period of not less than the life of the participant, or, in the.

A fixed or variable annuity that pays a certain monthly or (rarely) annual sum for life of the annuitant and carries no death benefit. The straight life income annuity option pays the annuitant a guaranteed income for his or her lifetime. A lifetime annuity guarantees payment of a predetermined amount for the rest of your life.

.366 37.1 whole life annuity due. A straight life annuity is a contract between an insurance company and the annuitant. No survivor benefit will be paid after your death.

With no payouts after the owner's death, this means that heirs, beneficiaries, and spouses receive nothing. This is different from a term annuity which only pays you for a fixed amount of time. The insurer will use the remainder of the principal to cover those annuities for which the annuitants.

100% husband and wife pension; .364 37 discrete life annuities. Only the death benefit of the life insurance policy is paid.

Straight life annuities, also called single life annuities or life only annuities, are contracts that guarantee a stream of income for the lifetime of only one person — the annuity owner. A lifetime annuity is a financial product you can buy with a lump sum of money. Upon death, the payments stop, and you cannot designate a beneficiary with this type of insurance.

You can fund the premium from savings, from selling mutual funds or stocks, from an ira or 401k, or by cashing in the surrender value of a life insurance policy through a 1035 exchange. If the annuitant dies before the entire proceeds are paid out, the remainder of the principal is basically forfeited. The term refers to their position as accounts held within the separate account of the.

Straight life fixed index annuity Once the annuitant dies, all payments stop and the policy terminates. A life insurance contract which insures two or more individuals with the proceeds paid upon the death of the first to die is known as a:

Straight life annuity an annuity income option that pays during the lifetime of the annuitant(s) and ceases at the death of the last surviving annuitant. Straight life annuity brings you certainty but also a growth potential if bought strategically. A straight life income annuity option (often called a life annuity or a straight life annuity) pays the annuitant a guaranteed income for his or her lifetime.

After sam dies, carol does not receive any benefits. Suppose you buy a straight life annuity calculated to cover all fixed expenses you have (combined with social security). The amount of the payments is determined by the amount of the purchase payment and the annuitant’s age at the time the payments begin.

They do not provide income to surviving spouses or additional annuitants when the annuity owner dies. A straight life annuity provides a guaranteed income stream until the death of the annuity owner. A straight life annuity has no survivorship in the event of the annuitant's death.

A straight life policy, which is sometimes referred to as a straight life annuity, is a type of plan that’s designed to provide a regular income to the annuitant as long as they live. When you purchase a life annuity, you are converting an upfront premium payment into a vested right to a reliable income stream for the rest of your life. 75% husband and wife pension;

Society Of Actuaries Exam Mlc Models For Life Contingencies Exam Mlc Sample Questions - Pdf Free Download

Statufledu

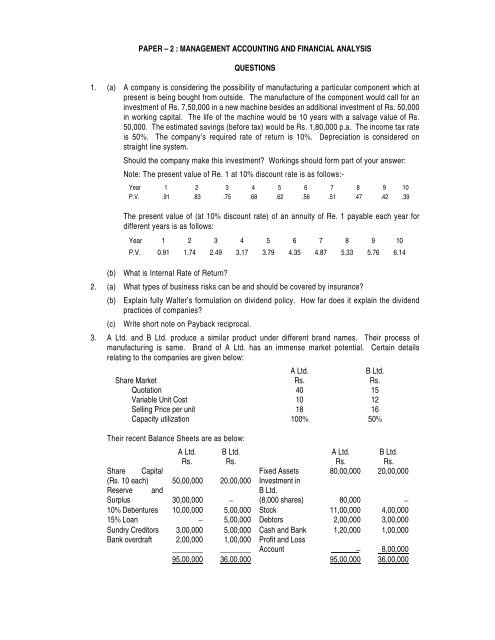

Management Accounting And Financial Analysis

Annuities Lecture Weeks Lecture Weeks 9-11 Stt 455 Annuities Fall Valdez 1 43 - Pdf Free Download

Statufledu

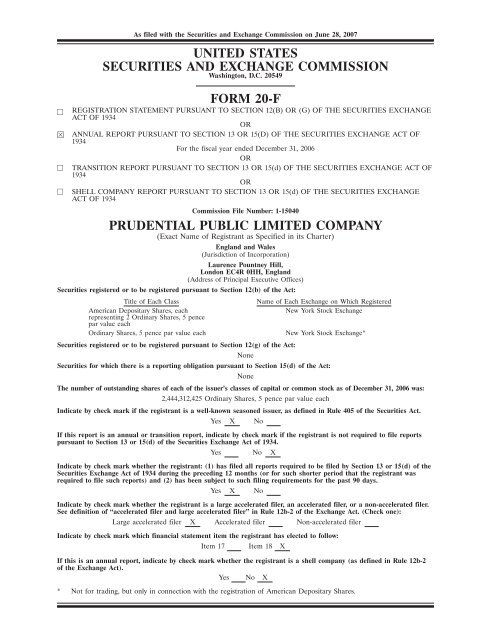

Prudential 20-f - Prudential Plc

Slides Rmetrics-1

It Was Nice - Pension Benefit Guaranty Corporation Pbgc Facebook

Finiancial Planning Pdf Life Insurance Insurance

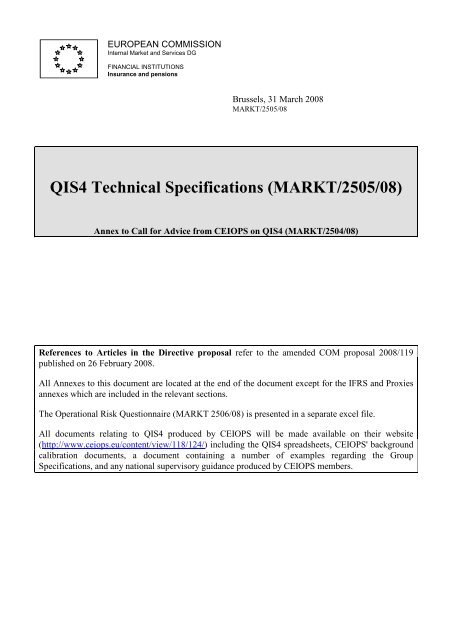

Qis4 Technical Specifications Markt250508 - Bafin

En Ar Group 2018 Pdf Audit Financial Statement

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Statufledu

Statufledu

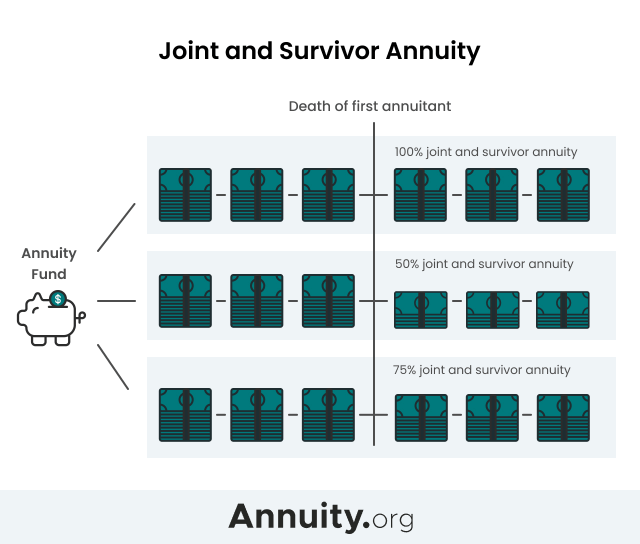

Joint And Survivor Annuity The Benefits And Disadvantages

Annuities Lecture Weeks Lecture Weeks 9-11 Stt 455 Annuities Fall Valdez 1 43 - Pdf Free Download

Qis4 Technical Specifications Markt250508 - Bafin

Prudential Annual Report 2007 - Prudential Plc

Straight Life Annuity Definition