Private Placement Life Insurance Uk

Ppli is an institutionally priced life insurance policy. If the wealthy individual invests in them in their personal.

Real Estate Private Equity Career Guide - Wall Street Prep

Growing regulation of financial products sales around the world has resulted in huge changes to the way such products are structured and marketed.

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Private placement life insurance uk. Private placement life insurance (ppli): Within our 1291 family you are connected to an international group of top professional experts in the field of private wealth solutions. Private placement life insurance (ppli) is defined as a flexible premium variable universal life insurance transaction that occurs within a private placement offering.

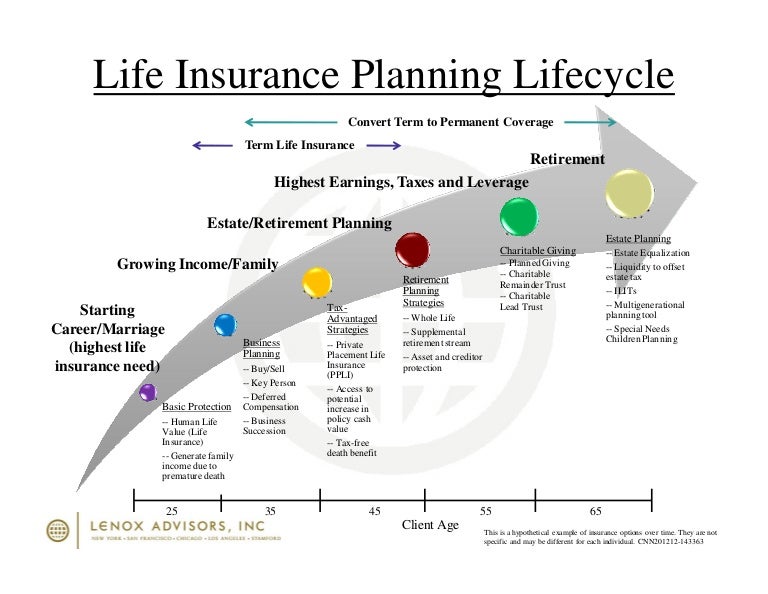

In its most basic form, ppli is a type of permanent cover life insurance offering a broad range of investment options into which the insurance company invests premium payments via segregated accounts on a tax free basis. Ad term life insurance your way. We are licensed in over 30 countries, we work with over 20 insurance companies in over 10 different jurisdictions and offer tax compliant solutions for clients from over 40 countries.

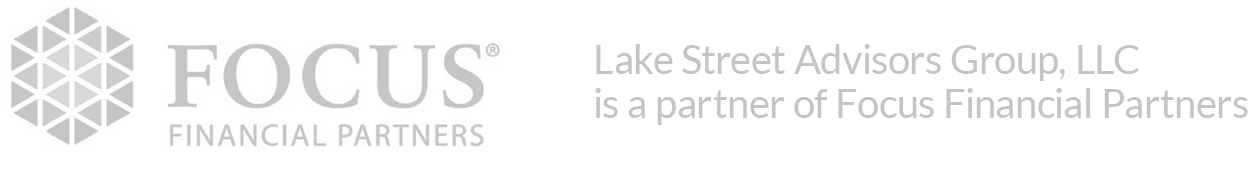

A private placement is essentially the private sale (or “placement”) of corporate debt or equity securities (or “issue”) by a company (or “issuer”) to a limited number of investors (aka lenders). Ppli owners and their financial advisors either choose specific investments for their portfolios or they carefully pick wealth managers to manage their portfolios within the policies. Private placement life insurance or annuities.

Term life insurance made easy. Historically, insurance companies refer to investments as purchasing “notes,” while banks make “loans.”. Likewise, a private placement life insurance policy eliminates “phantom income” from partnerships or pfics.

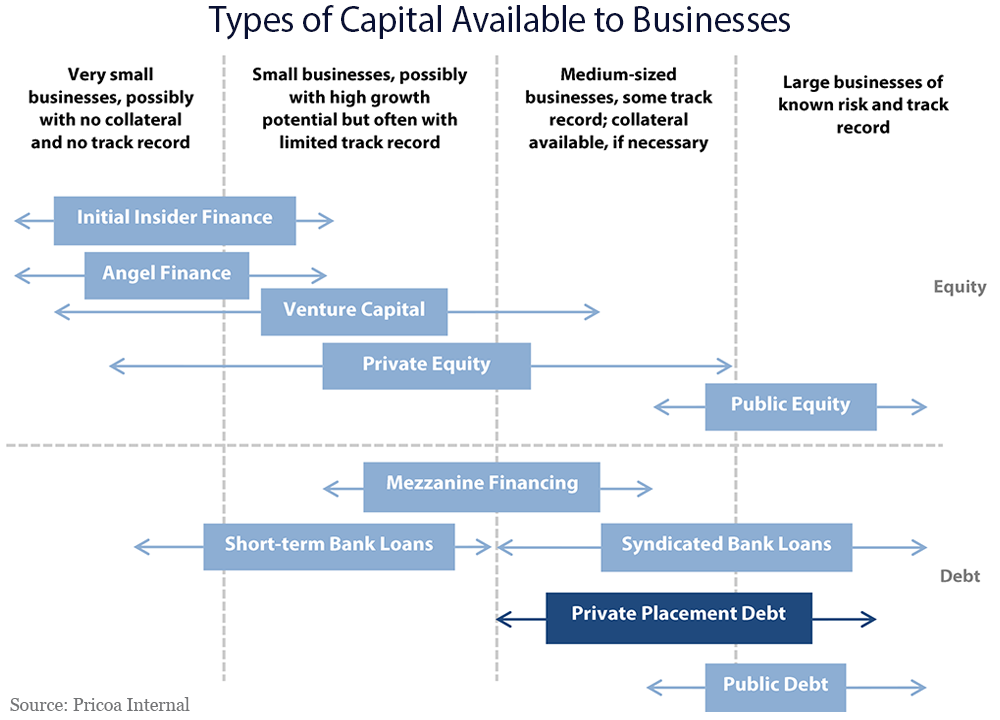

In general terms, life insurance is a contract between the investor (or insured party) and the insurer, where the latter promises to pay a designated beneficiary a sum of money upon the death, or in some. Private placement variable life insurance can be a useful utility knife for planners. Private placement life insurance [ppli] and private placement variable annuities [ppva] are offshore insurance solutions that are investment driven.

What is private placement life insurance? It's the only event that brings together the entire private placement value chain. Held in chicago in nov.

Term life insurance made easy. The buyers are typically institutional investors, such as insurance companies. Many times, those for whom ppli was designed want to invest in hedge funds, but hedge funds can carry significant taxes:

Visit the site to book tickets, see the event agenda and learn about our keynote speakers. One solution to many of the changes can be to advise the client to invest in a life insurance policy, such as a ppli. Private placement life insurance (ppli) is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit.

The only annual gathering for private placement life insurance professionals meet 200+ insurance. Private placement life insurance (ppli) provides another solution. Private placement life insurance & variable annuities forum is where the ppli and va industry meets.

Private placement life insurance, or ppli, is a customized version of variable rate insurance not available to the general public. A single premium life policy, it provides wealthy clients with high value life cover whose death benefit proceeds can cover any inheritance tax due on the investor’s estate. Here, paul golden looks at one major product category in.

Private placement life insurance (ppli) is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. Private placement life insurance is a form of cash value universal life insurance that is offered privately, rather than through a public offering. Ad term life insurance your way.

Horowitz, esq., gerald nowotny, jd, llm and bradley a. Barros | dec 14, 2020 I’ll close by noting that.

2

Uk Credit Insurance Specialists Ltd Arrange Credit Insurance Policy Cover For The Global Trade Market Imp Life Insurance Companies Insurance Company Insurance

Insurance Reinsurance - Transactional And Regulatory Practices Willkie Farr Gallagher Llp

General Accident Car Insurance Quote And Comparison100 Best Reviews Desirepaul Network

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Private Equity Definition How Does It Work

Private Placement Life Insurance Ppli - The Who What Where And Whynot And Howmuch - Lake Street Advisors

What Is A Private Placement

Private Placement Life Insurance Ppli Considerations For Alternative Investments

Top 10 Pros And Cons Of Variable Universal Life Insurance

Life Insurance Coverage Gap Deloitte Insights

Insurance Claim Life Cycle

How To Complete A Private Placement

Private Placement Life Insurance - Wikiwand

Life Insurance

Private Equity Services And Investment Deloitte Luxembourg

Real Estate Private Equity Career Guide - Wall Street Prep

2

Private Placement Life Insurance Ppli - The Who What Where And Whynot And Howmuch - Lake Street Advisors

![]()

How Does A Private Placement Program Work