Single Life Annuity Table

There are advantages and drawbacksto that, so here’s how a single life annuity works and what you need to know. Married retirees who select the joint and survivor option typically accept lower monthly

Annuity Table Letter G Decoration Ideas

Annuities, life estates & remainders;

Single life annuity table. Upon retirement, a plan participant, the case explains, can receive his or her pension benefits as a single life annuity—a check once a month for the rest of an individual’s life—or as a joint and survivor. An annuity table is a tool that simplifies the calculation of the present value of an annuity. Single life expectancy table for inherited iras.

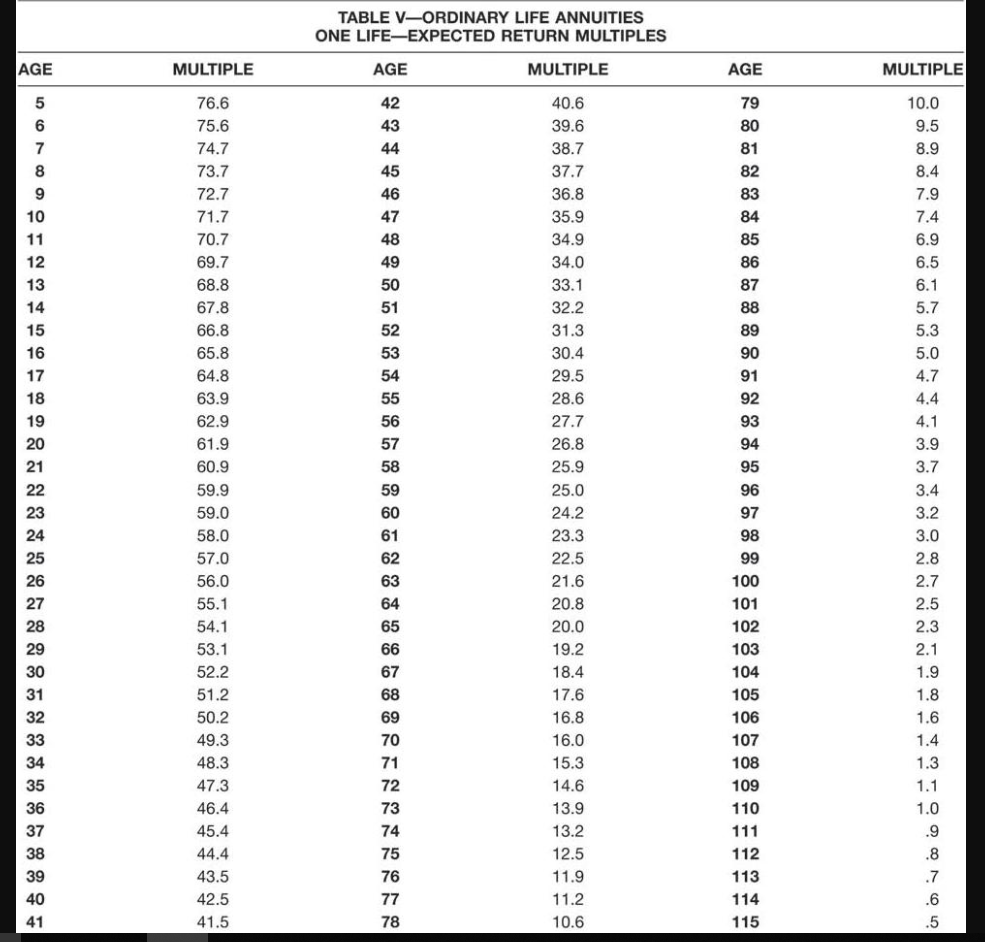

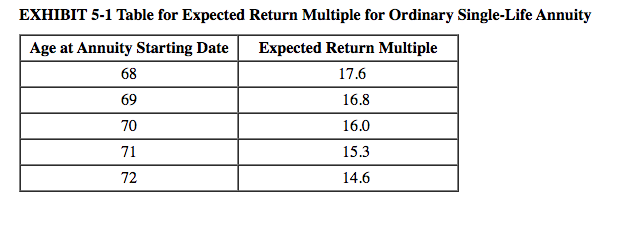

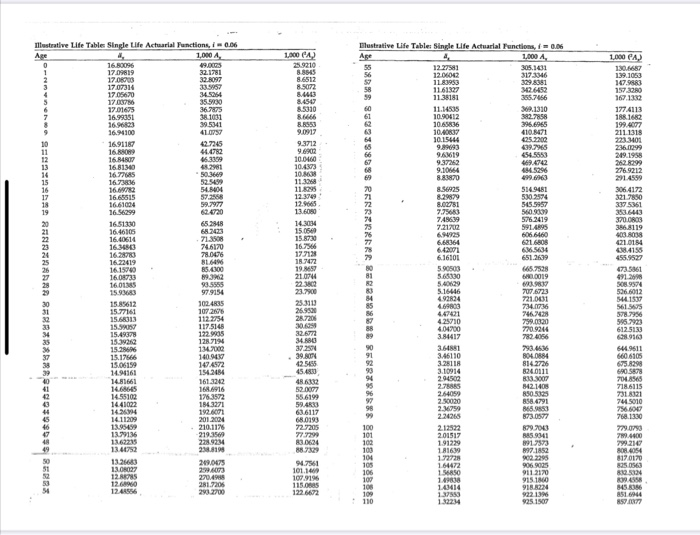

Table s, section 1, contains factors for the present worth of a life annuity, a life estate, and a remainder interest based on a single life. When using the 1983 individual annuity mortality (iam) table for males, the payments could. Single life 5 yr guarantee:

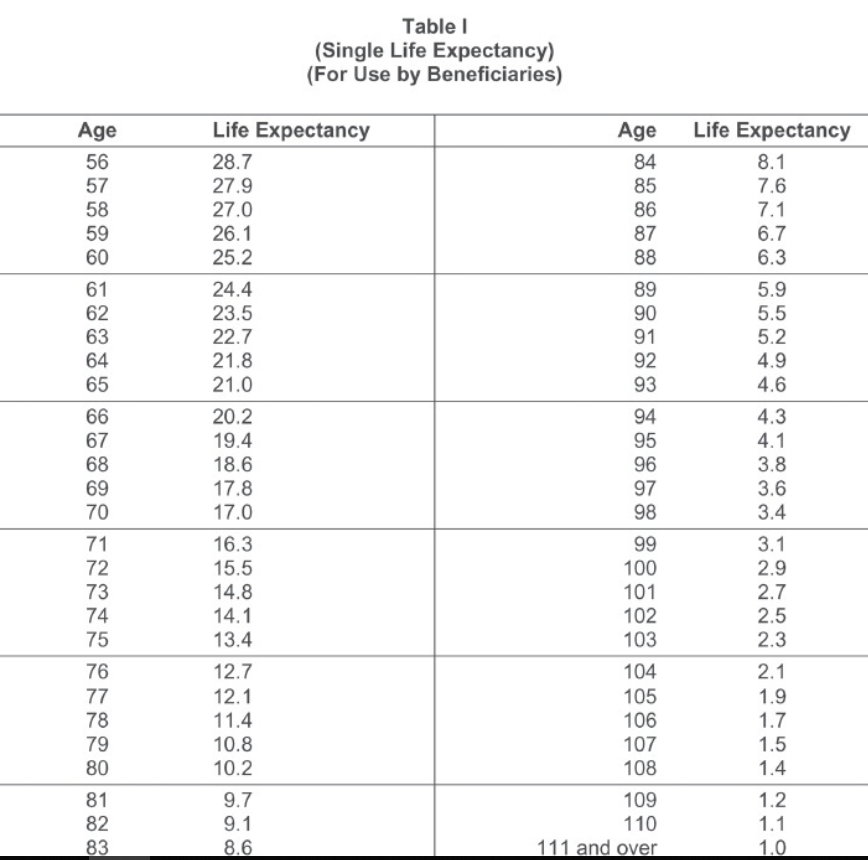

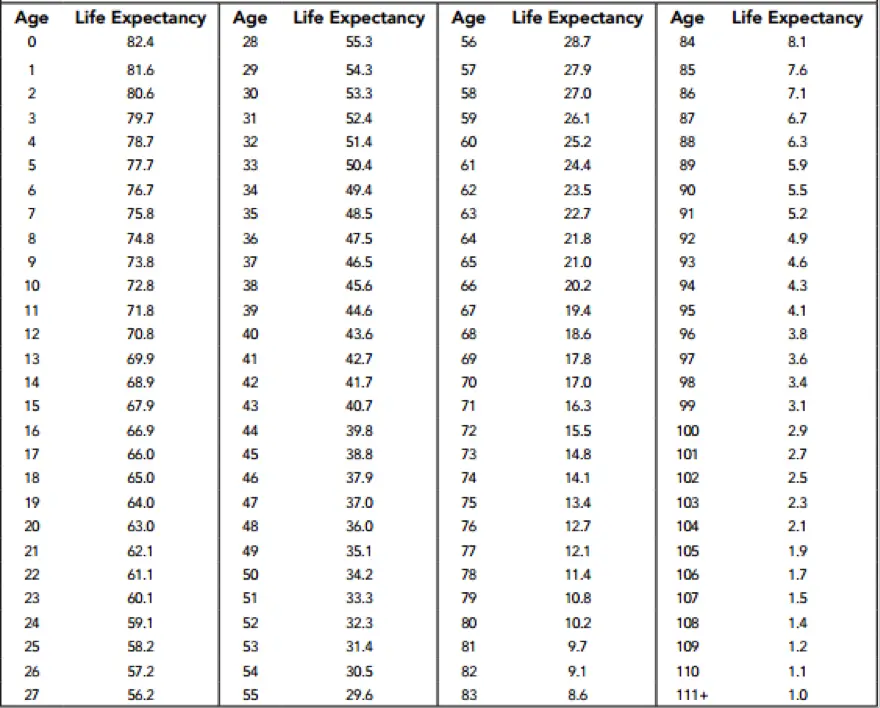

Single life rates for annuitants between ages 83 and 89 are graduated downward from the rate cap. If you must use table i, your life expectancy for 2021 is listed in the table next to your age as of your birthday in 2021. Single life annuity annual or monthly benefits paid beginning immediately and continuing for as long as the annuitant lives;

Single life 10 yr guarantee: Single life male annuity table guarantee 50 55 60 65 70 75; (1) the contract date is at age 70, (2) the first payment is at age 71, and (3) the last possible payment is at the end of the mortality table.

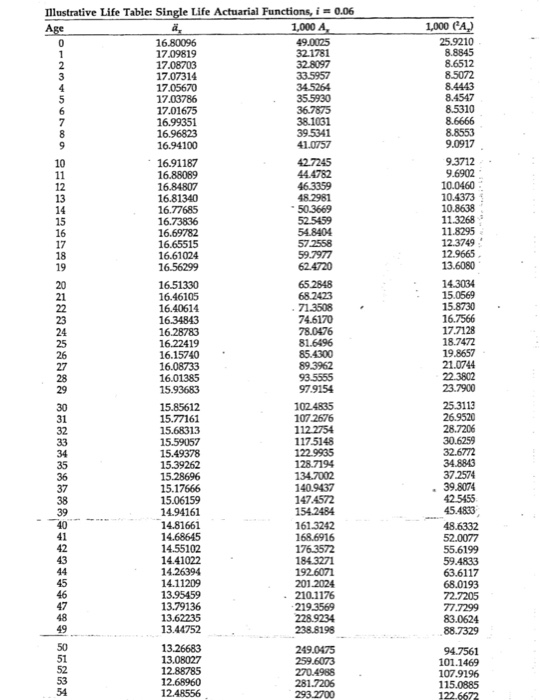

For the descriptions of the specific mortality tables available in the afc see mortality tables. Both table i and table ii are in appendix b. General formula using segmented interest rates and various ppa mortality tables.

22 rows annuity mortality table single life: Two life rates are capped at 8.4% for annuitants above 90 and are graduated downward in a similar way. When the annuity holder dies, the payments stop.

Table r(2) 8.2% to 12% xls Payments cease when the annuitant dies. Spouse beneficiaries who do not elect to roll the ira over or treat it as their own also use the single life.

If you use table ii, your life expectancy is listed where the row or column containing your age as of your birthday in 2021 intersects with the row or column containing your spouse's age as of his or her birthday in 2021. That factor is reduced by one for each succeeding distribution year. I= 5%, and the following extract from a life table:

Section name description # of pages file size (kb) 1: Table r(2) 4.2% to 8.0% xls: [i] for life with a provision for 100% of the annuity to the secondary annuitant on death of the primary annuitant.

Single life 15 yr guarantee: Table s xls single life factors: A single life annuity, or straight life annuity, can provide a retiree with a monthly paymentfor as long as he or she lives.

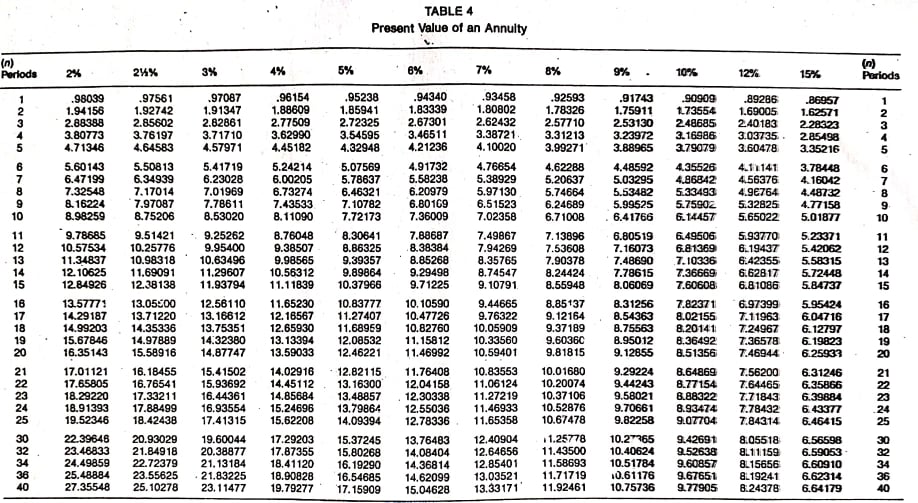

What is a present value of an ordinary annuity table? The annuity 2000 mortality table was adopted by the national association of insurance commissioners in 1996 as an appropriate table for valuing annuity interests. There are 5 functions for present value of single life annuities.

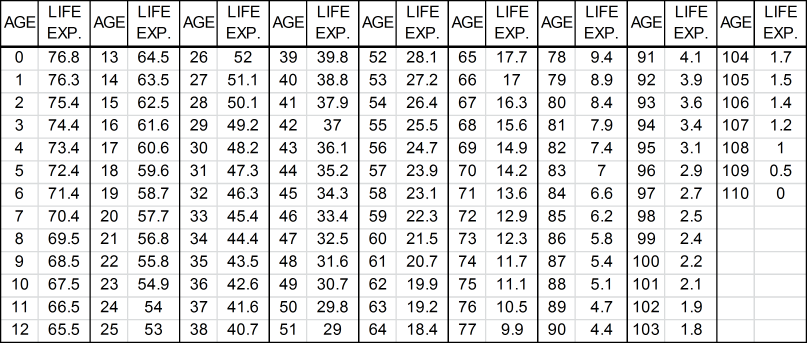

4 october 2021 last updated. An annuity is a series of payments that occur at the same intervals and in the same amounts. Designated beneficiaries use this single life expectancy table based on their age in the year after the ira owner's death.

Also referred to as a “present value table,” an annuity table contains the present value interest factor of an annuity (pvifa), which you then multiply by your recurring payment amount to get the present value of your annuity. For example, abc imports buys a warehouse from delaney real. For a given pension, a single life annuity generates higher monthly payments than a joint and survivor annuity, because it generally provides payments for a shorter period of time.

An example of an annuity is a series of payments from the buyer of an asset to the seller, where the buyer promises to make a series of regular payments. Table r(2), section 2, contains factors for the present worth of the remainder interest in $1.00 payable at the death of the last to die of two persons. 2the first table of suggested rates in 1927 was based on a.

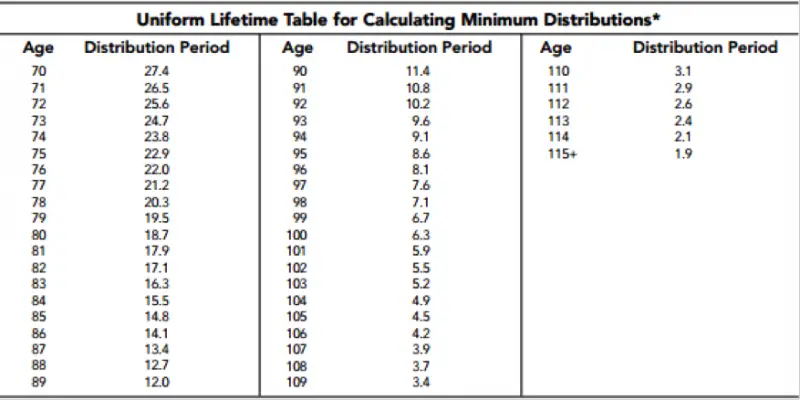

40 rows final mrd regulations: Life expectancy age male female ; Most states that require charities to maintain gift annuity reserves now require use of the annuity.

Table r(2) 0.2% to 4.0% xls: Single life pension option joint life pension option [h] for life with a provision for 50% of the annuity to the secondary annuitant on death of the primary annuitant. Single life table for inherited iras age of ira or plan bene˜ciary life expectancy (in years) ira or plan life (in years) 0 1 2 3 4 82.4 81.6 80.6 79.7 78.7 5 6 7 8 9 77.7 76.7 75.8 74.8 73.8 10 11 12 13 14 72.8 71.8 70.8 69.9 68.9 15 16 17 18 19 67.9 66.9 66.0 65.0 64.0 20 21 22 23 24 63.0 62.1 61.1 60.1 59.1 25 26 27 28 29 58.2 57.2 56.2 55.3 54.3 30 31 32 33 34 53.3 52.4.

Using pbgc lump sum basis (deferred and immediate interest rates) Table 1 below shows standard annuity rates for a pension fund of £100,000 after the tax free lump sum of £33,333 has been taken from the full fund of £133,333 for a single and joint life based on a.

Solved Determine The Tax-free Amount Of The Monthly Payment Cheggcom

Pdf Insurance Models For Joint Life And Last Survivor Benefits

Annuity Table Letter G Decoration Ideas

Illustrative Life Table Single Life Actuarial Cheggcom

Monthly Nominal Payouts For Life Annuities Purchased At The Minimum Sum Download Table

Solved Exhibit 5-1 Table For Expected Return Multiple For Cheggcom

Calculating Required Minimum Distributions For Inherited Iras - Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Solved Determine The Tax-free Amount Of The Monthly Payment Cheggcom

6 Alternative Annuity Designs Download Table

10 Planning Farm Systems Over Time

Mindenfele Lefuerdik Koppintson A Actuarial Tables - Disneycondonet

Illustrative Life Table Single Life Actuarial Cheggcom

Annuity Mortality Table Single Life - Annuities Retirement Planning

2

Annuityf Ordinary Annuity Table

Be Aware Of Tsp Spousal Beneficiary Rules Fedsmithcom

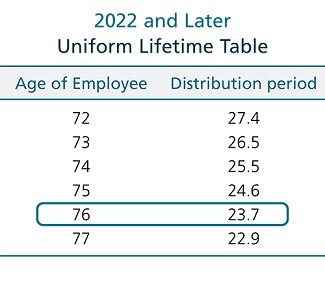

The New Year Will Bring New Life Expectancy Tables Ascensus

Be Aware Of Tsp Spousal Beneficiary Rules Fedsmithcom

Social Security Life Expectancy Tables My Annuity Store