How Much Does A 2 Million Dollar Life Insurance Policy Cost

$400,000 mortgage balance = $400,000 mortgage life insurance. There are hundreds of life insurance providers in the united states and most of these companies offer 12 to 16 rate classes.

Life Insurance Is More Affordable Than You Think Life Insurance Cost Term Life Term Insurance

While each company set’s their own risk classes and rates, the cost of a $5,000,000 term life insurance policy is primarily determined by these three factors:

How much does a 2 million dollar life insurance policy cost. Example costs for $2,000,000 (two million) dollars of life insurance: The best companies include banner life, protective, and lincoln financial. And single policy can easily be split three ways, if that’s what you’re going for.

How much does a million dollar life insurance cost? Depending on the underwriter you choose, you can get a million dollar insurance policy coverage for roughly $80 per month. You should plan ahead when considering such a serious decision, though plans for policies up to two million dollars can be purchased under the right conditions.

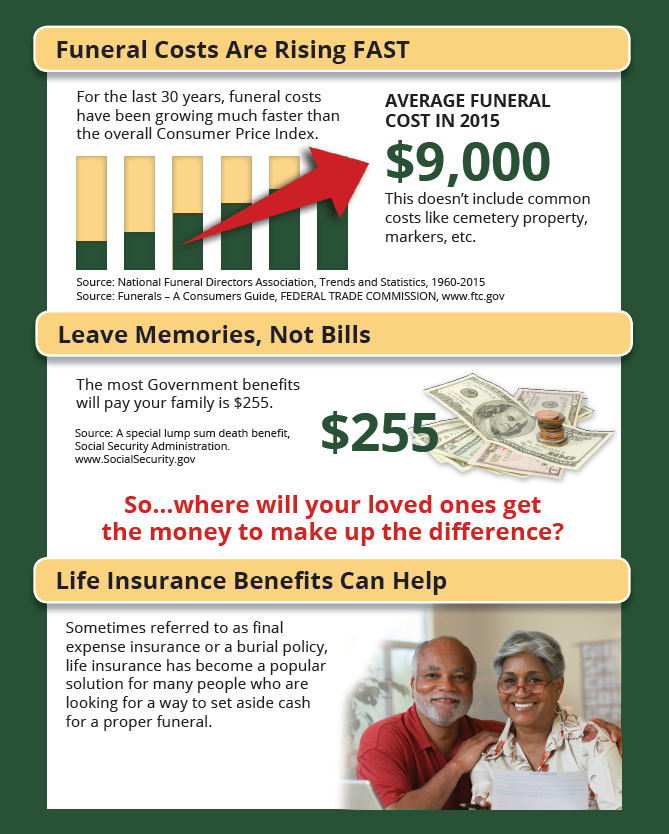

$200,000 income (x 3 years) = $600,000 life insurance. Like most things in life, it depends. We've found that the average cost of life insurance is about $126 per month, based on a term life insurance policy lasting 20 years and providing a death benefit of $500,000.

How much does a 500k life insurance policy cost? A life insurance policy for $2,000,000 to $5,000,000 of coverage if a huge financial liability for a life insurance company, and they will not offer this much coverage to someone who may have to serve time. Based off these numbers, the suggested coverage amount for each would be $1,200,000.

When determining how much a million dollar life insurance policy costs it is important to know that Sample $5 million term life insurance rates were run for 10 years, 20 years, and 30 years. A $2 million life insurance policy can cost as little as $2,000 for term life or $11,000 for guaranteed ul or $23,000 for whole life policy, annually.

We did the work and researched what your monthly premiums may cost you. You will need to undergo a medical exam for a policy over $400,000. Just like it sounds, this policy means your life insurance company will provide a $1 million cash payout to your beneficiaries if you die while the policy is active.

$2,000,000 15 year level term policy for a 40 year old male at the preferred plus rate class =. These factors could significantly impact the dollar amount needed. Net worth can also impact your insurance offer.

Call in and we can do a quick quote based on your age and health class in about ten minutes in about ten minutes. You can get this policy without an. How much does a $2 million life insurance policy cost?

$2,000,000 10 year level term policy for a 40 year old male at the preferred plus rate class = $60.90 month. Can anyone get a million dollar life insurance policy? The money comes with no strings attached, so your family can use it to replace your income, pay debts, or cover any other expenses.

The monthly cost for this type of policy will likely be at least several hundred dollars a month, so budget wisely. All requires 30 years of premium payments. A million dollar life insurance policy is a contract with a face value of a million dollars made between you and the insurance company.

A $4 million dollar term life insurance policy is not simply just twice the cost of a $2 million dollar life insurance policy, its actually far more complicated than that. The contract comes into effect when they receive your first premium and remains in effect for the duration of the contract, as long as you continue to pay your premiums. A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays, $1,000,000 of life insurance coverage might just be what you need.

If you are fairly young (30s, 40s, 50s) and have no major health problems, then getting coverage should not be difficult and still be low cost. Quotes for $5 million dollar life insurance. The cost of a million dollar life insurance policy will depend mostly on your age and health status.

You’re probably wanting to know how much a million dollar life insurance policy costs. For this example, we didn’t include additional debt, current savings and investments, or if they have a life insurance policy they plan to keep. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors.

That means $1 million in life insurance until you are 65, covering all those years of buying a house, settling down, and having children. How much life insurance do you need? A million dollar life insurance policy covers both needs:

Now, your will need to get an estimate for mortgage life insurance rates, along with an additional death benefit to cover your income. The medical exam required for a 2 million dollar policy is very similar to an annual physical with your doctor.

5 Different Types Of Insurance Policies Coverage That You Need In 2021 Insurance Benefits Disability Insurance Emergency Medical

Pin On Infographic

High Risk Health Insurance Plans Infographic Health Health Insurance Benefits

How Does Whole Life Insurance Work Costs Types Faqs

Life Insurance Quote - Hk Insurance Life Insurance Quotes Life Insurance Family Learning

Pin On Life

Can A Nursing Home Take Your Life Insurance

Whole Life Insurance Quotes Rates Policygenius

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Quotes Whole Life Insurance

2021 Final Expense Life Insurance Guide Costs For Seniors

Term Life Vs Whole Life Insurance Understanding The Difference - Clark Howard

:max_bytes(150000):strip_icc()/AAALifeLogo_resize-d7b51e467fdf421d9af5ef581e9286cb.jpg)

The 5 Best Return Of Premium Life Insurance Of 2021

8 Best Life Insurance Companies Of December 2021 Money

Life Insurance Over 70 How To Find The Right Coverage

How Much Does Million Dollar Life Insurance Cost Who Needs It In 2021 Life Insurance Cost Life Insurance Policy Life Insurance Companies

Term Life Insurance Tips On How To Secure Life Insurance As A Single Woman And All The Tips You Need To Kn Life Insurance Cost Life Insurance Quotes Term Life

Promoting Life Insurance To Millennials Life Insurance Facts Life Insurance Quotes Life Insurance Marketing

Best Life Insurance For Seniors

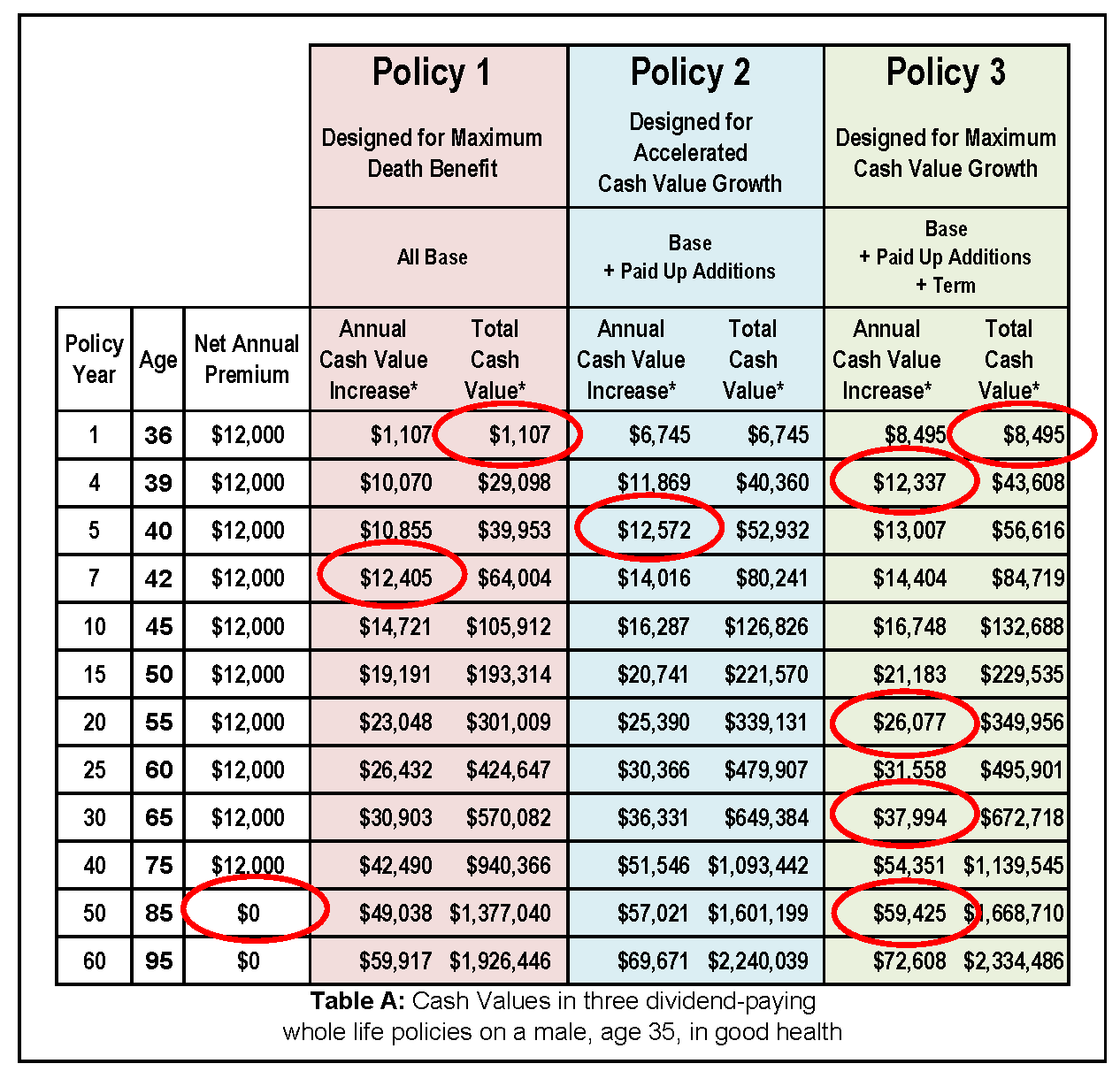

Paid Up Additions Work Magic In A Bank On Yourself Plan