Straight Life Annuity Calculator

The straight life annuity choice gives the retiree an income he cannot outlive. Annuities are one way to make your money work for you and provide a reliable income stream in retirement.

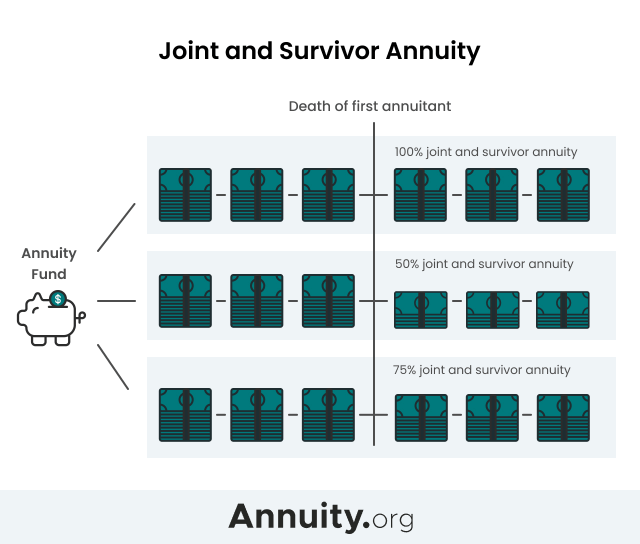

Joint And Survivor Annuity The Benefits And Disadvantages

This option helps protect against longevity risk, or the threat of outliving your money in retirement.

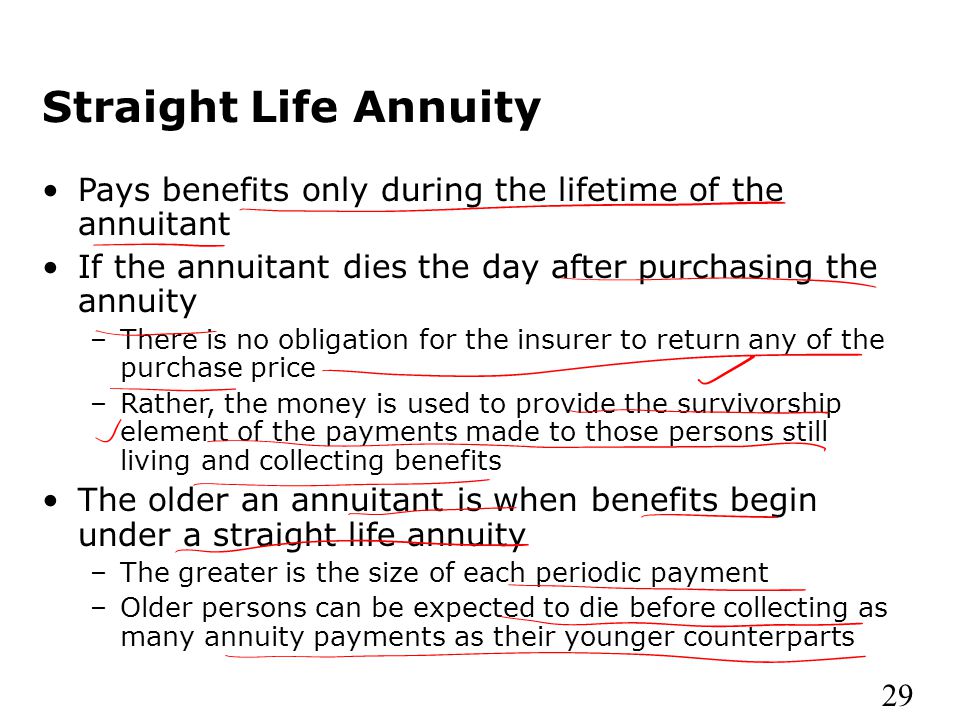

Straight life annuity calculator. The estimated and calculated rate of return of the annuity based on the information entered above. The payment that would deplete the fund in a given number of years. Also known as “lifetime annuities,” “lifetime income annuities,” or just “income annuities,” a straight life annuity is a contract between you and an insurance company under which you pay a large.

A straight life annuity is a type of annuity in which the annuitant receives payments for as long as they live. Present value of annuity = $90,770.40 / (1 + 10%) 20 present value of annuity = $13,492.44; Annuity rate of return calculator | annuity interest rate calculator.

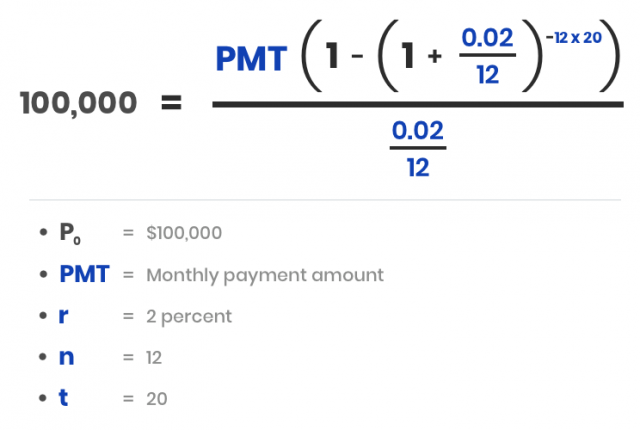

This protection is increasingly relevant as a growing number of americans report inadequate retirement. (a) how much monthly income you'll receive from an investment amount you enter, or, (b) how much you'll need to invest in order to receive the monthly income amount you enter. The total annuity payments made to the annuitant during the life of the annuity.

Actuarial tables, calculators & modeling tools. This change is designed to ensure that we are operating at the highest service level for in the midst of the current conditions. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

To start, select your age, gender, state of residence, and income start date. With it you can calculate either: A straight life annuity is a contract between an insurance company and the annuitant.

Like all annuities, a straight life annuity provides a guaranteed income stream until the death of the annuity owner. Annuities are issued by insurance companies that calculate payments based on economic and demographic factors as well as on the type of annuity. The policy’s duration is your entire lifetime, which is different from term life insurance , which ends after a specified number of years.

Use this income annuity calculator to get an annuity income estimate in just a few steps. Topics covered include health care, pension plans. You can estimate the monthly payments from an annuity if you know the price of the annuity, the fixed interest rate, the frequency of your payments — monthly, quarterly or yearly — and the number of years the annuity will provide you with income.

With the life expectancy of retirees continuing to lengthen, having a guaranteed life income provides a foundation. In the world of consumer retirement planning, straight life annuities are one of the most effective financial products for doing so. They may also be called single life, life only or straight life.

This is an advanced annuity calculator. The annuity calculator will bring back quotes for what it would cost to buy this level of monthly income. There are basically 2 types of annuities we have in the market:

Enter the savings you have available that you could convert to an annuity. Effective july 27, 2020, new $100,000 minimum for all annuity contracts offered through schwab. Life annuities, as the name implies, pay out for the rest of your life.

This calculator will provide estimates under different options. No survivor benefit will be paid upon your death. Use this calculator to help you determine how.

If the pension starts at 65, it has to pay at least $1,634/month. An annuity is an investment that provides a series of payments in exchange for an initial lump sum. Since you have $15,000 with you and you only need $13,492.44, you are covered and will be able to achieve your target.

A straight life insurance policy is a form of permanent life insurance with set premiums that provides a guaranteed death benefit. Because the payouts will be shorter in. The annuitant usually purchases the annuity with a lump sum deposit, and the insurer promises to make a fixed regular payment to the annuitant for life.

It can provide a guaranteed minimum interest rate, with no taxes due on any earnings until they are withdrawn from the account. The annuity calculator will tell you how much monthly income it would produce for the rest of your life. Straight life annuities do not include a death benefit, so payments can’t be made to a beneficiary.

Often, a straight life annuity is purchased shortly before the annuitant wants regular payments to begin. A straight life annuity, sometimes called a straight life policy, is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. Having the right tools within reach helps you complete your everyday actuarial tasks with ease.

The society of actuaries research institute offers many tables and tools, including mortality tables, calculators and modeling tools on risk topics. This option pays you the maximum monthly benefit for your lifetime only.

Annuity Formula Calculation Examples With Excel Template

Page Title

Annuity Sign And Calculator Money For Savings Stock Photo - Image Of Economy Sign 117615464

Straight Line Depreciation Calculator Double Entry Bookkeeping

Annuities And Individual Retirement Accounts - Ppt Video Online Download

Period Certain Annuity What It Is Benefits And Drawbacks

What Is A Straight Life Annuity Retirement Watch

Straight Life Annuity Providing Peace Of Mind In Your Retirement

16 Annuity Calculators The Annuity Expert

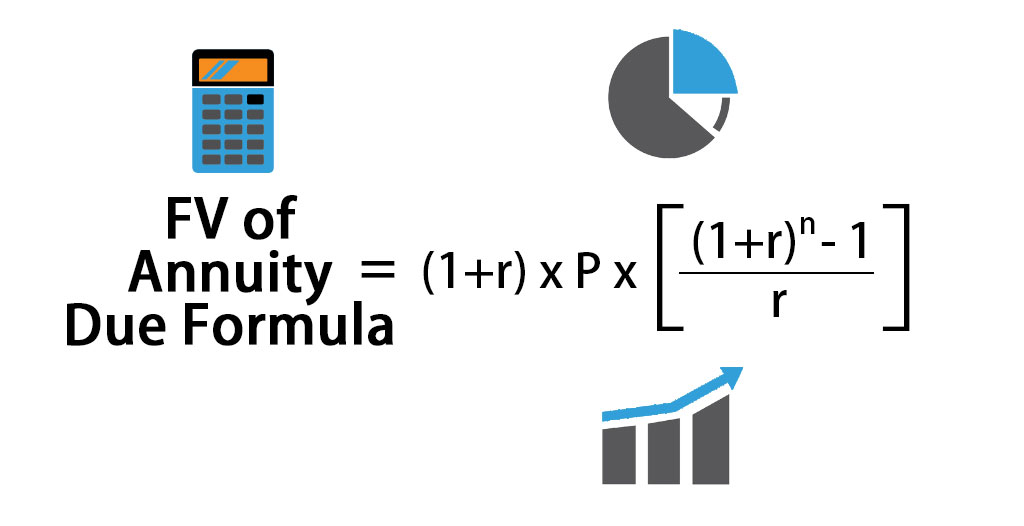

Future Value Of Annuity Due Formula Calculator Excel Template

Immediate Annuity Calculator Calculate Your Projected Payout

Annuities And Individual Retirement Accounts - Ppt Video Online Download

16 Annuity Calculators The Annuity Expert

2

Present Value Of Annuity Due Formula Calculator With Excel Template

Future Value Of An Annuity Formula Example And Excel Template

When Can You Cash Out An Annuity Getting Money From An Annuity

Immediate Annuity Calculator Calculate Your Projected Payout

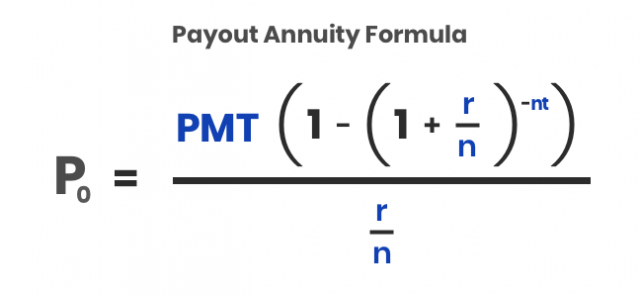

Annuity Payout Options Immediate Vs Deferred Annuities